Call us now:

Introduction of TDS & ETDS

Tax deducted at source (TDS) means the process of collecting tax from the source of income. TDS is not a separate or new form of tax, but a mode of collection on a current income basis. It is collected not to make a burden to taxpayers during the time of tax filing. The process of filling TDS, through the means of electronics, is known as E-TDS.

Following procedures should be followed for E-TDS filing.

-

- Go to the www.ird.gov.np

- Click on the taxpayer portal

- Expand E-TDS by clicking on the “+” sign of E-TDS.

- Click on E-TDS. (Now, one form will appear for the submission number)

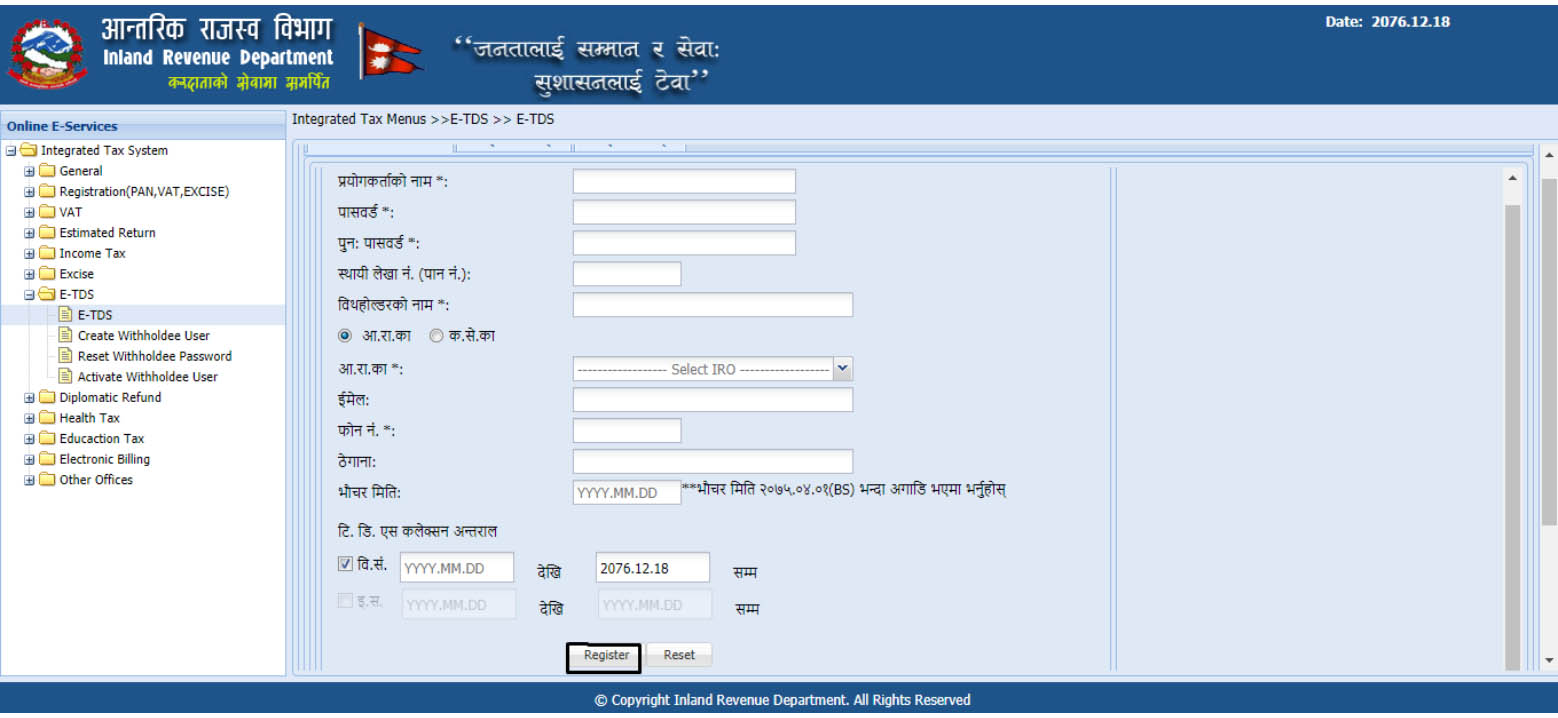

- Fill all the required information in the form. (Note.: * sign is mandatory)

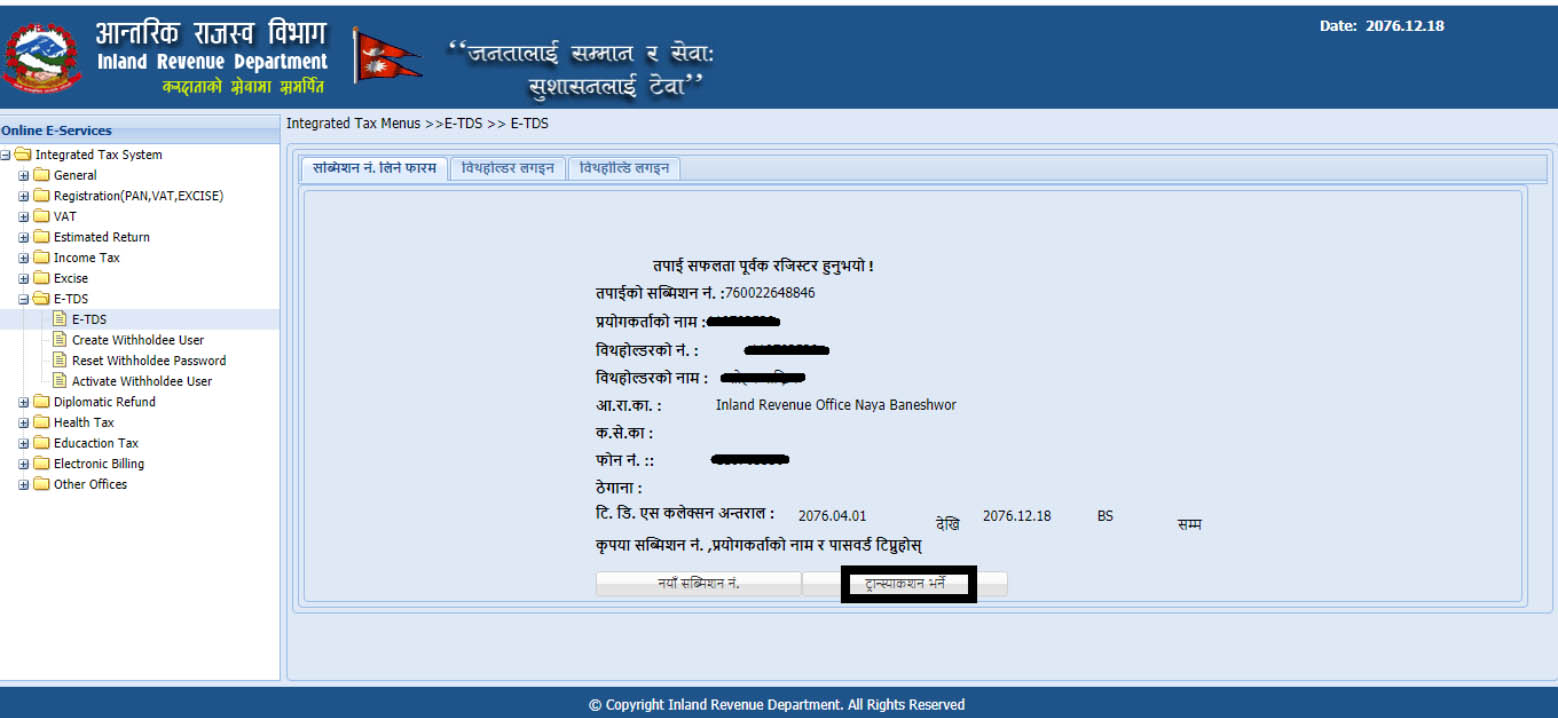

- After filling then click on register and note the submission number.

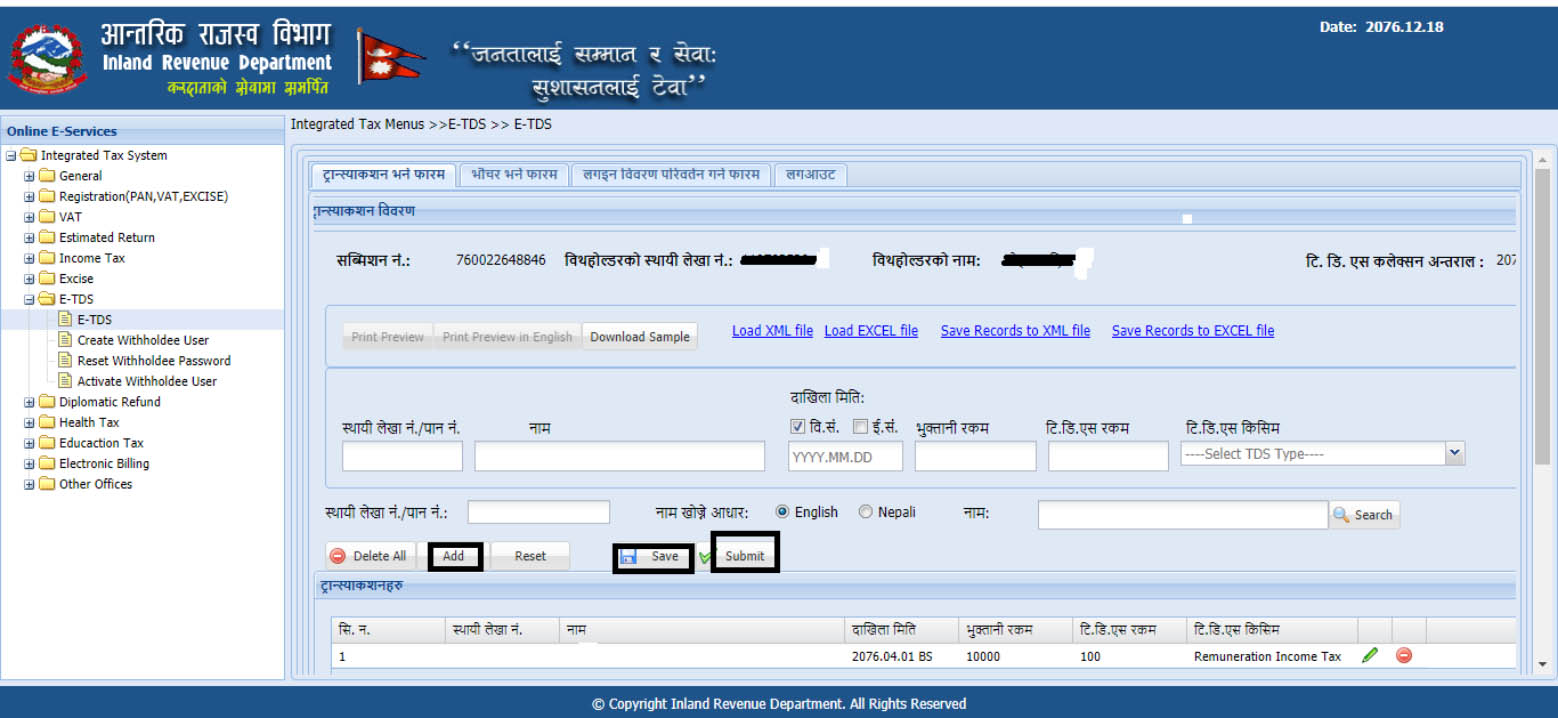

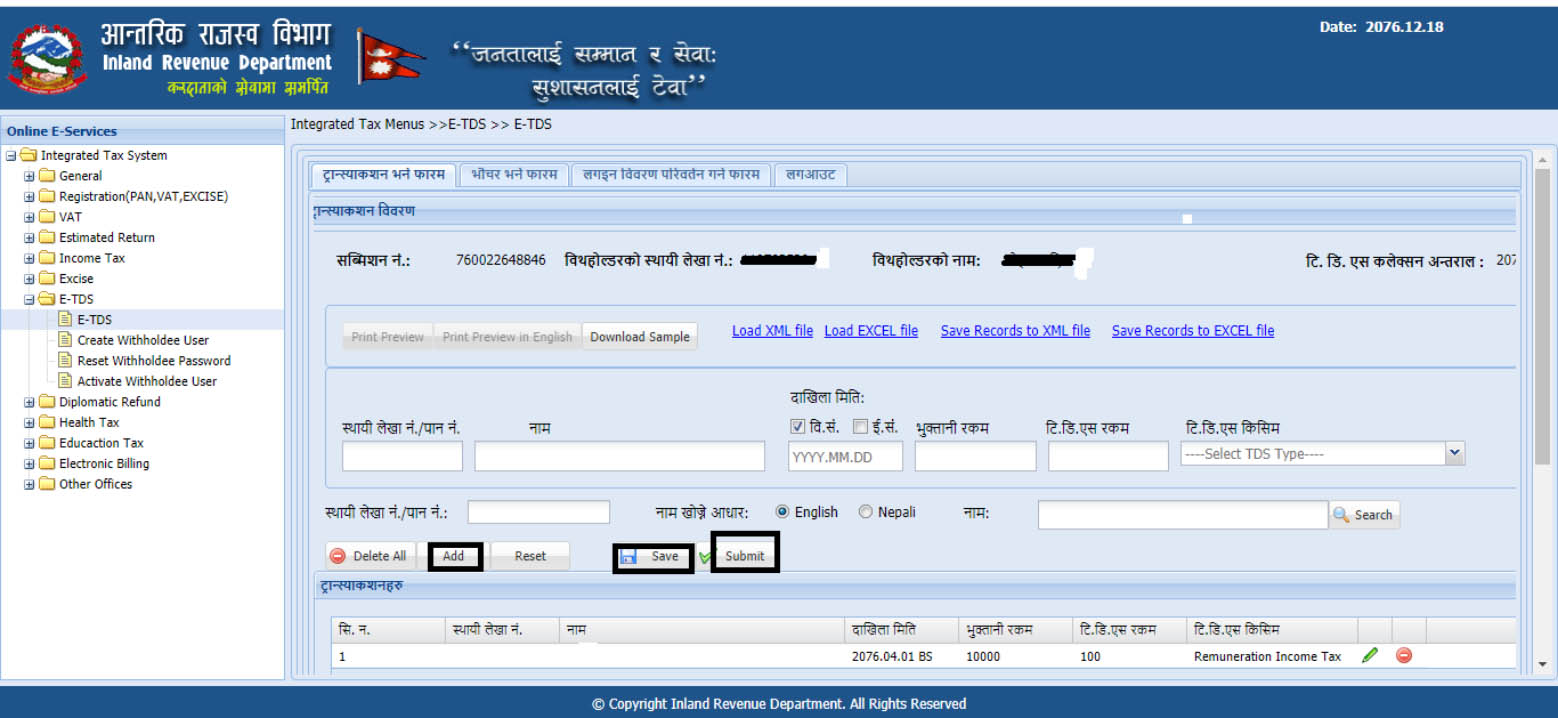

- Click on “ट्रानजाकसन भर्ने” then another form opens.

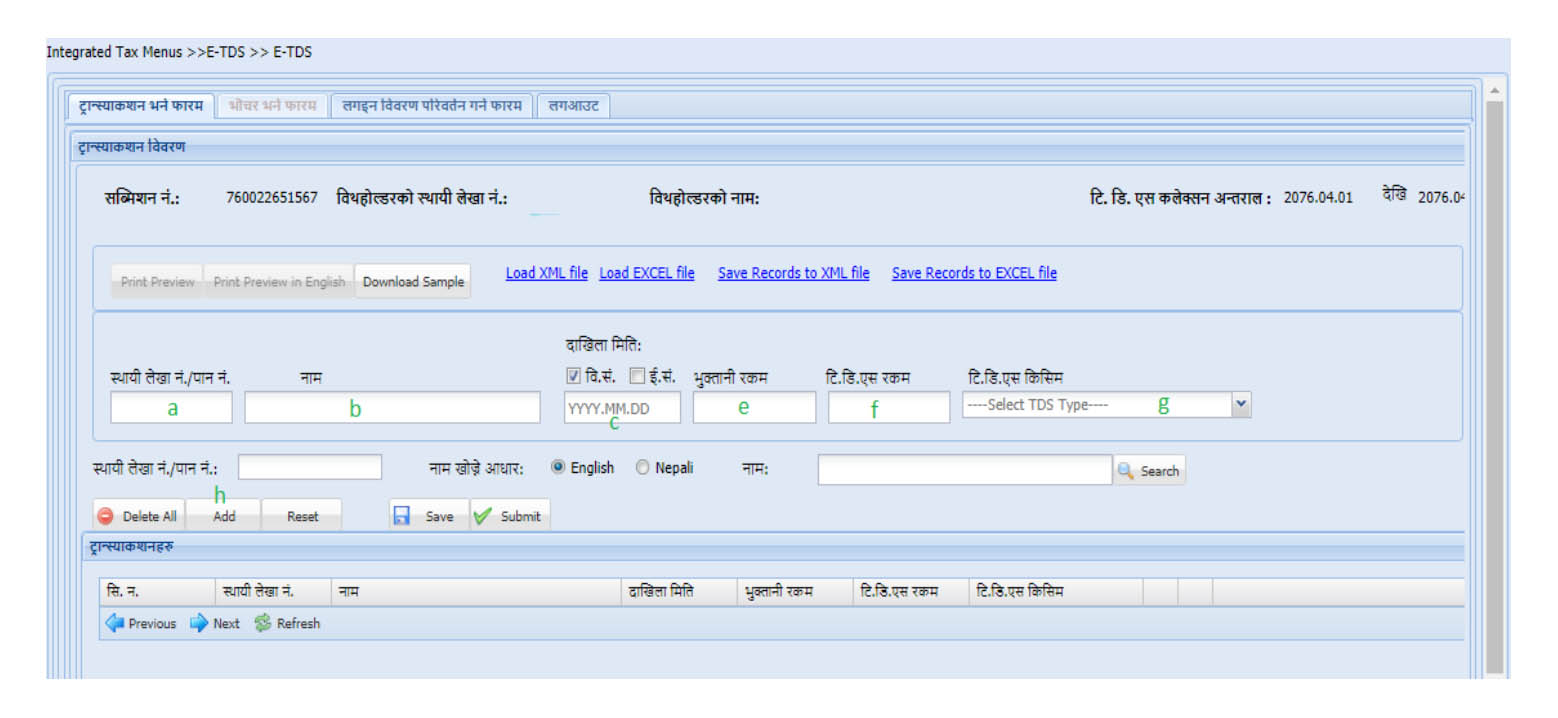

- Fill in the following information in the opened form.

a. PAN No. of liable person who is liable to pay TDS.

a. PAN No. of liable person who is liable to pay TDS.

b. Withholder’s Name is automatically displayed if PAN is entered or if PAN is left blank then enter the name of the taxpayer.

c. Click on B.S. or A.D. for the date.

d. Enter the Date in “YYYY.MM.DD” format.

e. Enter the total taxable amount.

f. Enter the TDS amount which you have already calculated.

g. Click on TDS type in which subject TDS is to be paid e.g. Rent TDS, Salary TDS etc.

h. Click on “Add” to add the record.

i. Repeat these steps until all record is entered.

j. When all data is recorded then click on Save.

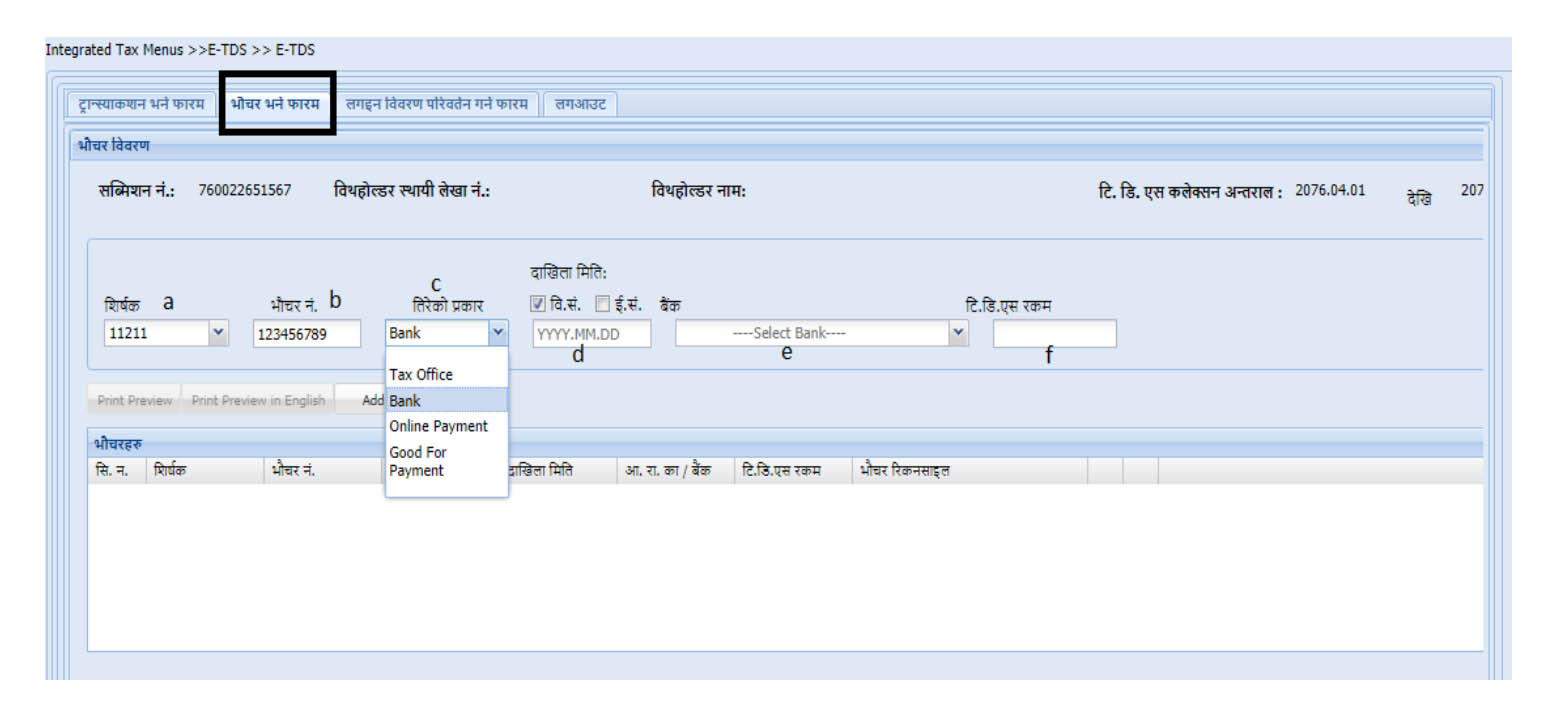

j. If data is in Excel format then click on “Load Excel file” upload the Excel file and click on “Save records on Excel file” to save the Excel file. - When all the TDS detail is entered voucher information should be filled. So, click on “भौचर भर्ने फारम” then please follow the following procedure.

a. Tax deducted code number.

b. Voucher number or cash receipt number

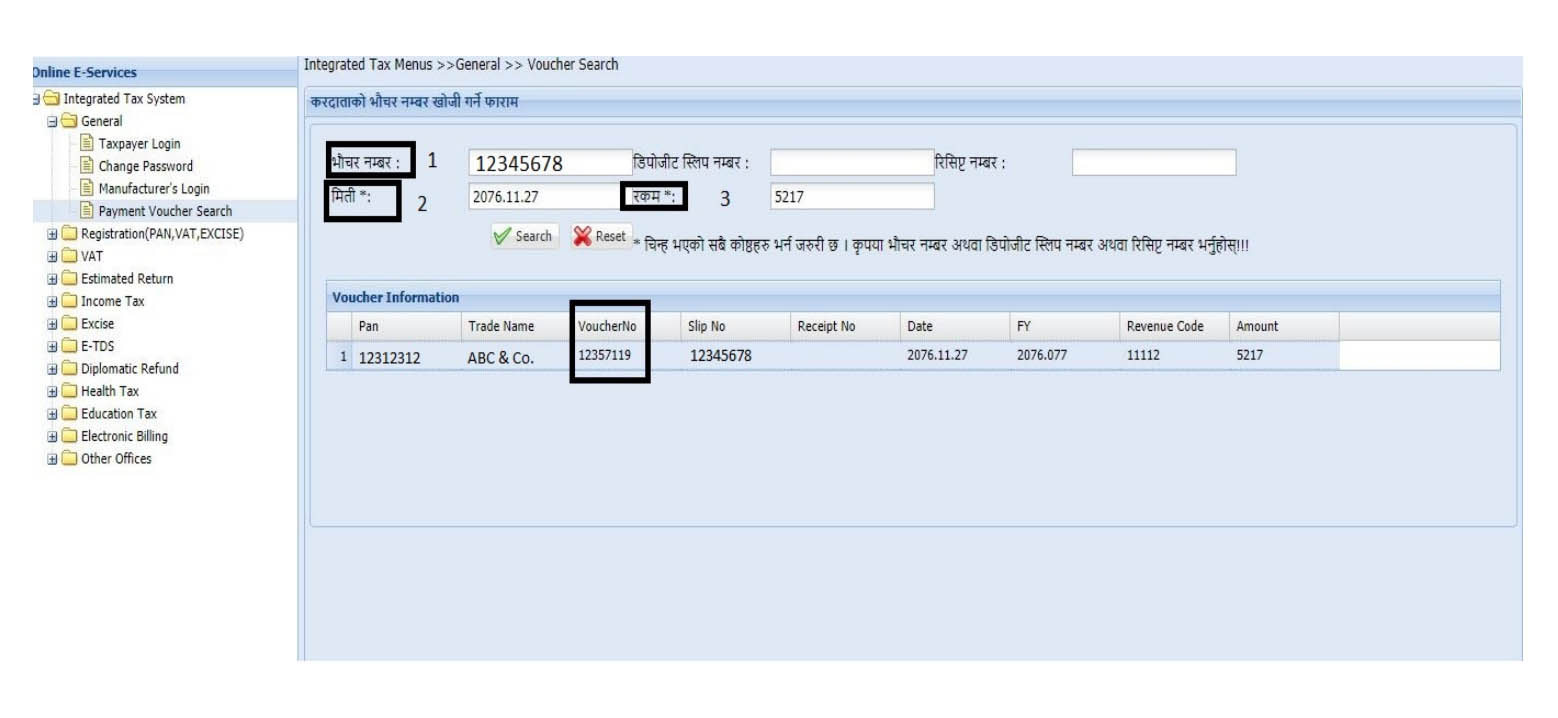

The voucher number should be generated first

* Go to General

* Payment Voucher search

* Fill the three boxes in the form voucher number, date & Amount from the Tax deposited voucher

* Select ‘Search’After selecting search just below Voucher information will appear in the 3rd Colum new Voucher Number will be generated. As shown in the picture below:

c. The payment type may be cash or bank (if paid at the Bank counter then select Bank).

c. The payment type may be cash or bank (if paid at the Bank counter then select Bank).

d. Date Format “YYY.MM.DD”

e. Name of the bank if payment is made from the bank, if payment is made through cash name IRO or TSO.

f. Branch Name of IRO

g. TDS Amount/Voucher amount.

h. Then click on Add ButtonWhen every step is completed click on the submit button on the previous 1st page.

Note I: In the above picture in Voucher Reconcile Column should show Reconciled if Not Reconciled is shown then while filing the return some mistake has been made and it has to be rechecked.

After submitting E-TDS final step is to visit the Tax office & verify the filed return until & unless we verify from the tax office process is not completed. We should take the submission number & tax-paid voucher to the tax office and request for verification. - Note II

* To edit the transaction click on the “Green Edit Icon.”

* To “Remove” the transactions click on the “Red Minus icon.”

* To save the list of transactions to an Excel file click on “Save records to EXCEL file”

* To save the list of transactions to an XML file click on “Save records to XML file.

* To clear the field click on the “Reset” button.