Call us now:

Introduction

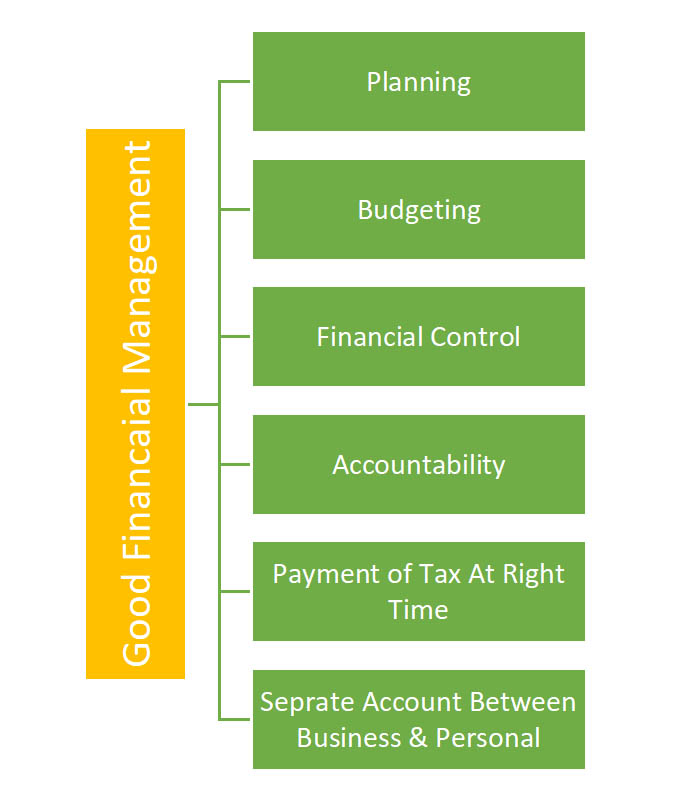

Financial management is a process of proper utilization of the funds invested in an organization by planning, organizing, controlling and directing financial activities of any organization, like budgeting, management of funds, determining the sources of funds, allocation of funds, cash management & financial control, etc. And the process of implementing the financial activities in the best possible way.

Some of the good financial management practices are briefly described below:

Planning

The first and foremost work to be done is planning. We must precisely define our objectives and identify and quantify available and potential resources.

Budgeting

Budgeting is the process of prediction or estimation of Revenue & Expenses for the upcoming period more often for the financial year. Budgeting helps in identifying areas that incur the most operating costs, or exceed the budgeted cost. It also helps organizations function with financial efficiency & reduce wastage. And most important part of budgeting is ensuring sufficient liquidity to cover operating expenses.

Financial Controls

Financial control is the process & rules of utilizing available resources & identifying financial risks and minimizing those risks in the right way, in the right place at the right time. There are many techniques for financial control: Ratio Analysis, Cost Management, Profit and Loss Control & Financial Forecasting, etc.

Accountability

Accountability means bearing duties and responsibilities by the accountable person effectively otherwise he/she will be answerable. It is very important to bring smoothness and effectiveness to financial management practices.

Payment of tax at the right time

Government tax should be paid at the right time. A firm shouldn’t be delayed in paying tax otherwise fines will be charged.

Make a separate account between business & personal accounts

There should be a separation between personal and business accounts. Don’t do any personal transactions in a business account. It is important because it helps to identify the company’s actual profit and loss & reduces confusion and makes a clear account.